How the "One Big Beautiful Bill" Impacts Your Taxes in 2026

- lckconsulting

- Aug 24, 2025

- 2 min read

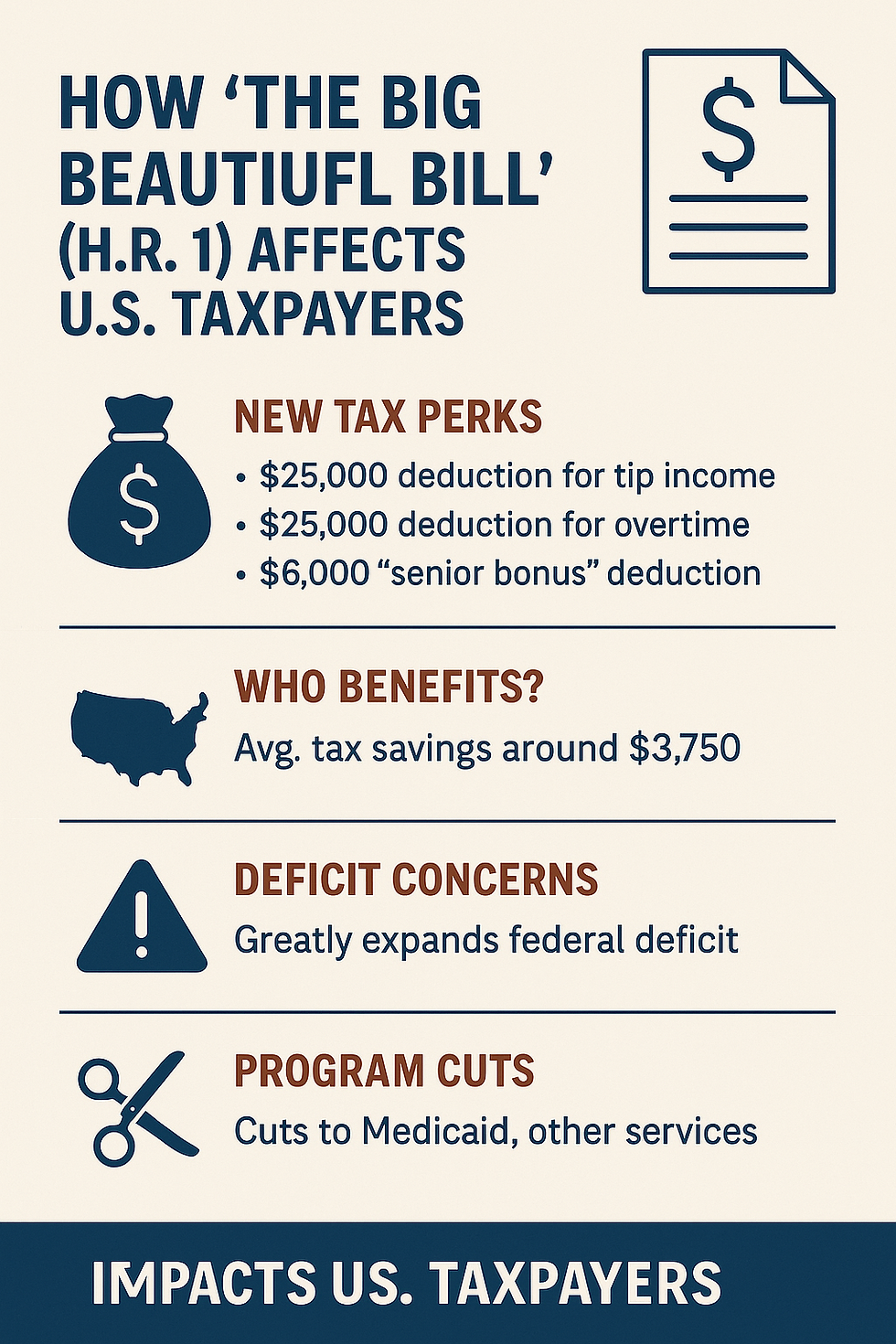

What’s in the Big Beautiful Bill?Signed into law on July 4, 2025, the One Big Beautiful Bill—H.R. 1 of the 119th Congress—continues many of the 2017 Tax Cuts and Jobs Act provisions and introduces an array of new deductions and credits. These include expanded standard deductions, a boosted child tax credit, a deduction for tipped and overtime income, and a new "senior bonus" deduction, among other changes.(statesman.com)

Who benefits the most?On average, individual taxpayers across the U.S. could see savings of about $3,750, while households may receive around $2,900 in tax relief. Some regions experience large gains—residents in Central Texas’s Travis County may see reductions exceeding $8,300.(statesman.com)

New tax perks unveiledThe bill introduces key deductions starting in 2025 (with some expiring in 2028), including:

Up to $25,000 deduction for tip income

Up to $12,500 (single) / $25,000 (joint) deduction for overtime pay

A $6,000 bonus deduction available for seniors

Higher standard deduction and an enhanced child tax credit(taxfyle.com, NBC Los Angeles, The Guardian)

Long-term reach and rising concernsWhile these cuts may offer immediate relief, the bill greatly expands the deficit—adding trillions in debt—and includes sweeping program cuts. Medicaid and SNAP face major reductions, and public services like food assistance are shifting to state budgets, which may force local governments to compensate with cuts or tax hikes.(Axios)

Bottom line for your neighborsIn the short term, U.S. taxpayers should enjoy lower federal tax bills and benefit from new deductions for families, seniors, tipped workers, and overtime earners. But these gains come amid significant cuts to safety-net programs and a mounting fiscal burden—creating a mixed outlook for long-term economic stability.

Comments